Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

I think the real solution is not to lend on fake money. Tax or no tax, it wasn’t taxes that caused the market crash in 2008.

The top 10% own 67% of the wealth in the U.S.

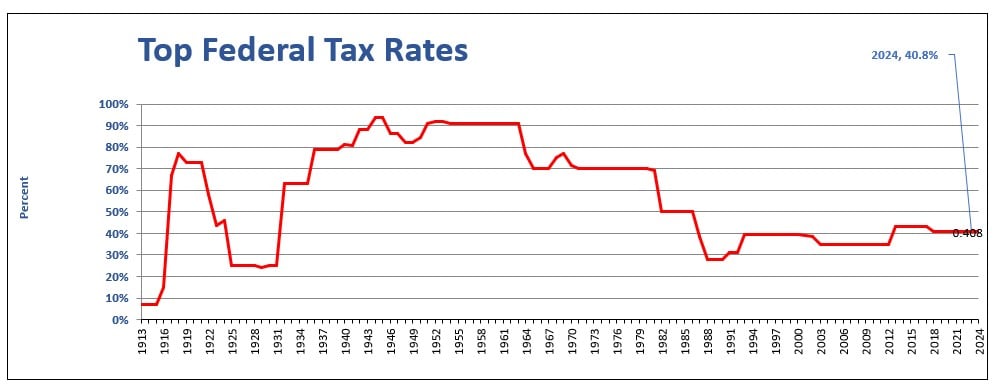

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50’s through the early 80’s, that tax on the wealthiest was at 70%.

Now it’s at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you’d only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.

What’s crazy is to calculate the average US income the census folks of the US government exclude billionaires because it would skew reality so much that people would call bullshit on the average with billionaires in the mix.

so they get to be excluded from the “average wage per family” calculations made and distributed by the government.

I think a law stating you can’t borrow against unrealized gains would be sensible.

You can keep your unrealized gains forever, live of your dividends for all i care, and pay no tax. But realizing them, either through selling or borrowing against, triggers a taxation.

Or doing so, it counts the loan as income and is taxed accordingly. But seriously, the main aim itself can also be taxed. A house is…

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

I wouldn’t be a huge fan of taxing unrealized gains if we hadn’t been cutting taxes for the rich for 50 years. How else are we ever going to recover from that? These guys COULD have done the right thing and supported sensible taxation policies, but they didn’t, so fuck 'em. At this point it’s either this or the guillotine.